Guide for first-time buyers

We're glad you've found your way to us at Eqvor!

Interest in unlisted shares has grown strongly in Sweden in recent years, and this has led many first-time buyers to seek us out at Eqvor.

We get a couple of calls a day from first-time buyers who have practical questions about how to buy unlisted shares and the idea is that this text will answer all these questions and concerns that you may have before entering this world.

There is a difference between Public and Private unlisted shares

It may sound strange that there are public unlisted shares, but it is actually true.

When you look at unlisted companies to invest in, there are both public and private. The difference between these is that public unlisted companies are connected to Euroclear and are so-called "reconciliation companies". What this means in practice is that you can keep these shares in a regular share depository at, for example, Avanza or Nordnet. This means that when you buy this type of shares, they are delivered directly to your share depository. Unfortunately, it is not possible to store in an ISK. If you have ever owned a listed company that has been delisted, you may have noticed that the share is still visible in your depository but has the value 0. This is a public unlisted company and exactly how it will look in your custody account if you buy a public unlisted company through us at Eqvor.

What are private unlisted companies? A private unlisted company is an ordinary limited company that maintains its own share register, usually via an online digital service, but the company itself is responsible for updating the share register as shareholders buy and sell shares. If you as an investor buy shares in a private company, this means in practice that you are entered directly in the company's share register, so you do not need to keep the shares in a depository. When you buy this type of share, you will receive a certificate from the company showing that you have been entered in the share register with the correct number of shares.

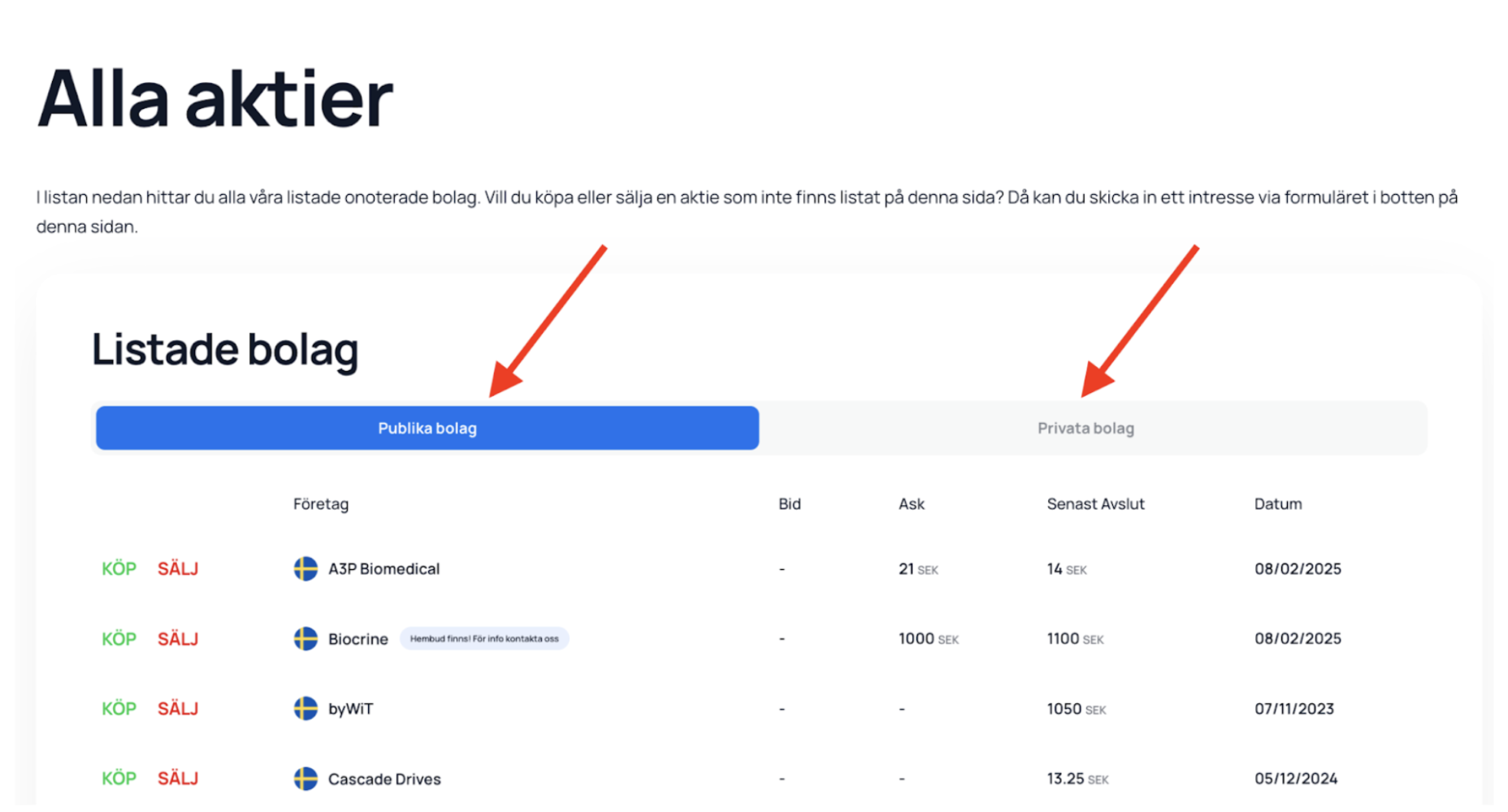

In Eqvor's service, we have made it clear to you as an investor which companies are public and which are private, you can see this in 2 places:

- In the share list for all shares you will find 2 buttons "public companies" and "private companies", click on these buttons to see lists of each type of shares.

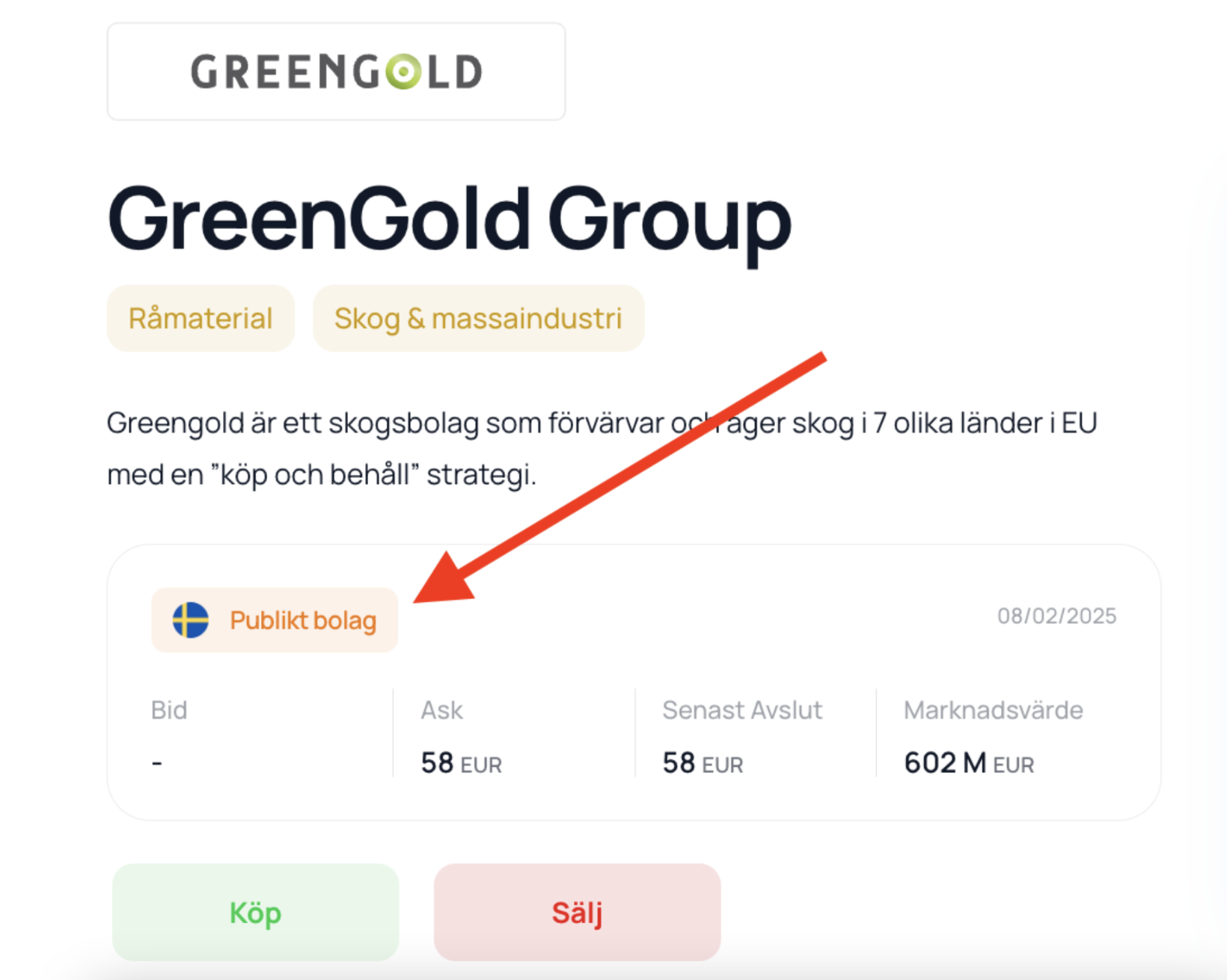

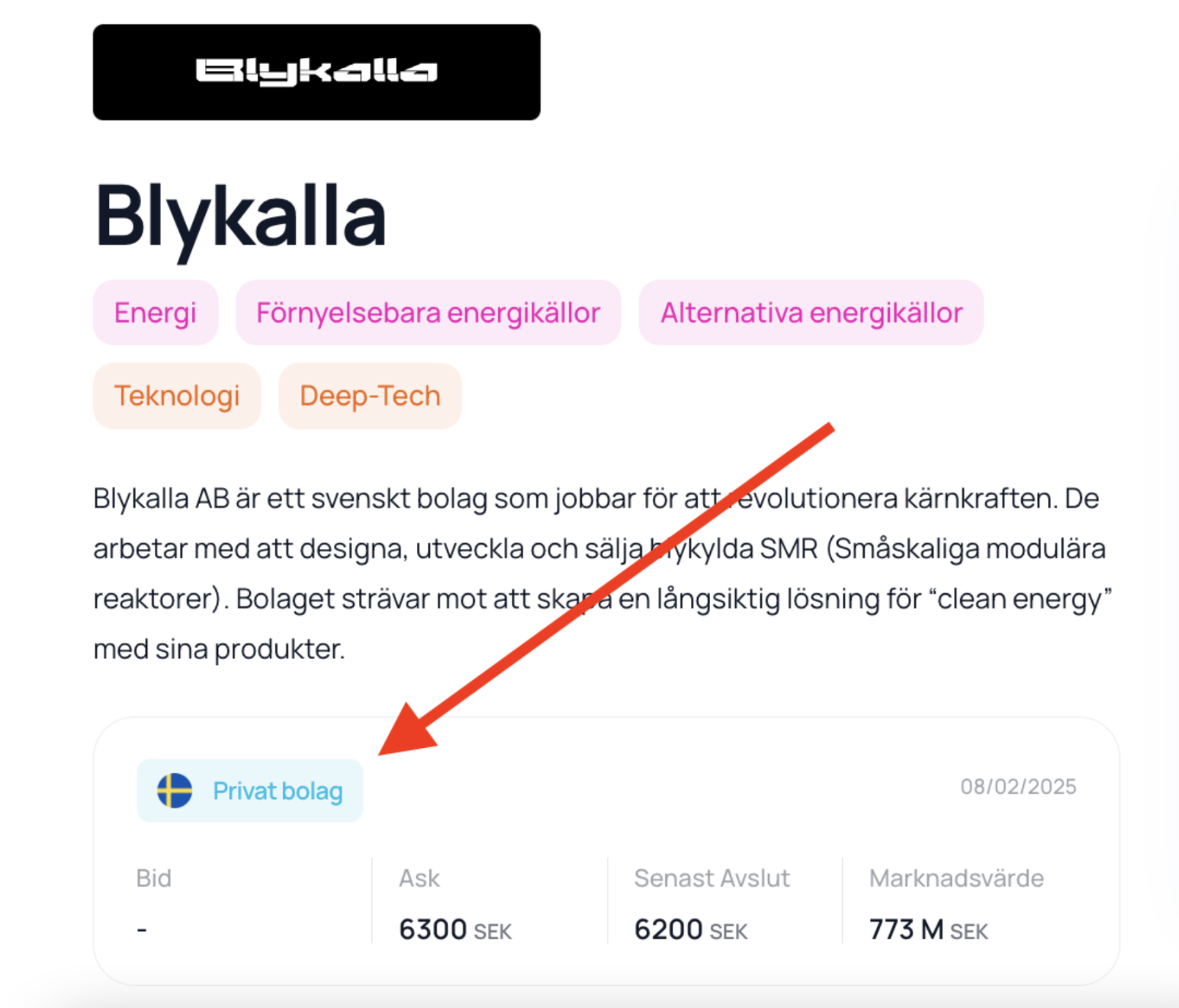

2. on each company's info page there is an icon showing whether the company is public or private.

Example of a public company:

Example of private company:

How does pre-emption work and what is it?

Now you know the difference between private and public companies, let's go through a pre-emption/pre-bid which is the next thing you might encounter. Some companies will have a pre-emption or pre-bid clause in their shareholder agreement, this basically means that existing shareholders of the company have the right to buy the shares that you are going to buy for the same terms as you INNAN you, they usually have between 20-30 days to make a decision on this.

We will use an example to show how this can affect you in practice. Suppose you are going to buy 1000 shares in Company A for SEK 1000 per share and Company A has a 30-day pre-emptive offer, then the following happens. On the day that your order has been finalized with a seller in Company A and all contracts are signed, the seller notifies the management of Company A that he/she has sold 1,000 shares for $1 per share, the management then notifies the other shareholders that they now have the right to acquire these shares on the same terms as you.

After 30 days have passed, one of 2 things will happen:

- In this case, you do not receive the shares and the contract you entered into with the seller is no longer valid and is canceled. You do not have to pay any money to either Eqvor or the seller. What people usually do in these cases is to place a new order at a slightly higher price in the hope that existing shareholders will not take advantage of the pre-emption.

2. Existing owners do NOT use the pre-emption right. This means that you will receive the shares, when you receive this message, you now usually have 2-3 banking days to transfer payment for the shares. Eqvor will provide you with instructions on where and when to transfer the payment. When you transfer the payment, you will also receive a message from the company welcoming you as a shareholder and usually you will need to enter into their shareholder agreement so that you have the right to use the pre-bid for future sales.

Pre-emption is unusual in public companies but does occur, pre-emption is common in private companies. If you want to know what applies in the particular company you want to buy, it is easiest to contact us at Eqvor directly and you will get this information from us.

How does order placement work in practice at Eqvor?

You now know the difference between public and private companies and how the pre-emption may affect the transaction. Now we'll go through the practicalities of placing an order on Eqvor, when and how to pay the settlement and what steps you need to go through.

Order placement

The first step is to place an order, click on all shares in the menu and click on buy on the share you want to buy. You can then immediately choose how many shares you want to buy and at what price. Next, you can choose whether you are buying as a company or as an individual. If you are buying as a company, you need to enter your company name and organization number. You will then need to fill in which custody account you want the shares delivered to (NOTE This applies to ONLY if the company is publiclyThen click submit and your order will be created, in the last step you need to fill in a KYC (Know your customer) this is something we must collect by law to comply with current legislation on money laundering and terrorist financing. You only need to fill in the KYC for your first order.

After you have placed your order in the system, you will receive an order agreement sent to your email, this agreement specifies the share you are going to buy, the number and price and Eqvor's brokerage fee for the transaction. Once you have signed this, the order is binding and appears in our order flow on the website (you are always anonymous).

You can choose to cancel your order at any time, you can do this either by clicking the cancel button or by calling or emailing us and we will cancel your order. It is completely free to place an order and free to cancel an order, you only pay commission if your order goes to settlement and you have received the shares you have purchased.

Transfer of funds

You never need to transfer money to Eqvor or hold money in a custody account or account with us to be able to trade as you have to do on, for example, Avanza and Nordnet. When your order has been completed, you will receive a notification from Eqvor and it is only then that it is time to pay for the shares.

If the company you have bought is public, you will receive a contract note which you send to your bank or securities company where you want the proceeds to be deducted, giving your bank all the instructions they need to make the transfer of the proceeds. This settlement note will also serve as your receipt for the transaction and as an accounting document for tax and other purposes.

If the shares you have bought are in a private company, you will have to sign an additional agreement once your order has been completed, known as a "Purchase agreement" between you and the seller. This agreement specifies the terms and conditions of the transaction and the account to which the proceeds will be transferred. This agreement also states whether the shares are subject to pre-emption, however, we at Eqvor will always notify you of this when you place an order so that you know what to expect. If the shares are subject to pre-emption, you must wait for the pre-emption before transferring the proceeds, if existing shareholders do not buy the shares, you then transfer the proceeds to the account specified in the purchase agreement or you instruct your bank to transfer the proceeds according to the agreement.

Receipt of shares

After you have transferred the funds, it is time to receive the shares.

If the company you bought shares in is public, you will have the shares delivered directly to the custody account you specified when you placed your order. Usually the shares are delivered to your account within 2 business days of you transferring the funds.

If the company is private, you will be entered directly in the company's share register and will receive a message directly from the company's management or investor relations officer with proof that you have been entered in the share register.

It's done! You are now a shareholder in an unlisted company and can join us on an exciting journey.

Frequently asked questions & answers

Is there a risk that I overpay but never receive shares?

No, this cannot happen.

When you buy public shares, both buyer and seller transfer the payment and shares to the securities company "Evida AB" to which Eqvor is an affiliated agent. Evida is a securities company under the supervision of the Swedish Financial Supervisory Authority. When Evida has received both shares and payment from the buyer and seller in the transaction, they then transfer the payment to the seller and the shares to the buyer. If the seller does not fulfill its commitment, you will receive the cash back.

When you buy shares in a private company, the management of the company knows about the transaction and informs you when it is ok to transfer the proceeds, so there is no possibility for the seller of the shares to receive the proceeds and not give you the shares because the management of the company checks the share register and updates it. You will also receive proof of this when the share register is updated.

We at Eqvor are also with you along the whole journey, keeping you updated on every step so that you know what is happening and what is expected of you.

What do I do if I want to sell my shares?

If you want to sell your shares in the future, follow the instructions under the heading order placement, but this time click on sell instead of buy. Instead of specifying a custody account, you now specify an account to which you want the proceeds to be delivered at closing.